By Adyasha Mallick, AI Engineer & Robocommodity Consultant- METAL

The first quarter of 2025 has already established itself as one of the most turbulent periods in recent commodities history. As markets continue to move with unprecedented velocity, trading organizations face a stark reality: adapt digitally or risk being left behind. At Commodity Roundtable, where the industry’s brightest minds converge, we’re seeing a clear demarcation between organizations embracing technological transformation and those struggling to maintain their footing in this new era of super-volatility.

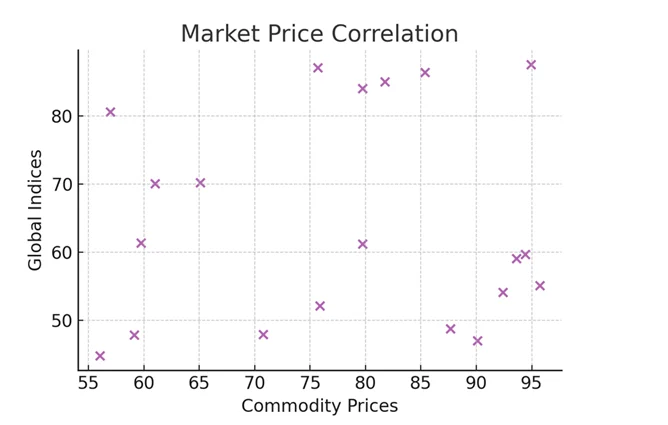

Having spent the past few years at the intersection of digitization and commodities trading, I’ve observed how digital maturity increasingly correlates with trading performance. The sophisticated ERP and CTRM implementations we’re deploying today bear little resemblance to the rudimentary systems of even five years ago. This evolution couldn’t have come at a more critical time.

Oil Markets: Navigating the New Geopolitical Reality

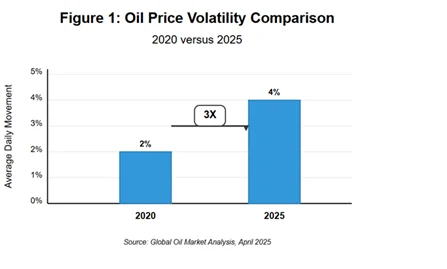

The oil sector’s volatility in early 2025 makes the pandemic-era price swings look almost quaint by comparison. With production realignments following the Eastern Mediterranean tensions and the acceleration of North American capacity, traders are contending with intraday price movements that would have previously defined entire quarters.

What’s particularly interesting is how different digitally mature organizations are responding to these challenges. Traditional trading houses still rely heavily on analyst forecasts and positional hedging, while digitally transformed enterprises are leveraging real-time data streams and algorithmic response mechanisms.

Metals: Supply Chain Intelligence as the New Competitive Edge

The metals sector presents its own unique challenges in 2025. The global push continues to strain critical mineral supply chains, creating volatility that ripples across industrial metals and non-ferrous metals alike.

What’s fascinating about this sector is how digital transformation is redefining traditional trading advantages. Historical strengths like geographic proximity to production or legacy relationships are being challenged by organizations with superior data insight capabilities.

The recent copper market turbulence provides a compelling case study. When Indonesian production faltered in February, organizations with advanced supply chain intelligence platforms detected the disruption patterns before they became widely apparent. One trading house we work with had integrated satellite imagery analysis with production data monitoring, providing them with a 72-hour informational advantage—an eternity in today’s hyper-reactive markets.

Digital Maturity Assessment Framework for Metals Trading Organizations:

Level 1: Basic digital tools, primarily focused on transaction recording

Level 2: Integrated ERP/CTRM systems with standardized reporting

Level 3: Predictive analytics capabilities with structured data inputs

Level 4: AI-enabled decision support with multi-source data integration

Level 5: Autonomous trading capabilities with human oversight

Our analysis indicates that each step up this maturity ladder correlates with approximately 12-18% improvement in trading performance during volatile periods. The gap between Level 2 and Level 4 organizations has been particularly striking during recent market disruptions.

Agri: Smartly navigating from fields to forecasts

In today’s agri commodity markets, staying competitive means more than tracking crop prices—it means connecting the dots faster than anyone else. From unpredictable weather patterns to rapid shifts in global demand, agri traders face constant volatility. That’s where RoboCommodity ERP steps into not just as a system of record, but as a real-time intelligence platform.

📊 Unified Data, Smarter Decisions

RoboCommodity ERP brings everything under one roof—procurement, logistics, pricing, contract management, and risk exposure. No more juggling spreadsheets or jumping between disconnected systems. Traders can see their entire position—across crops, regions, and currencies—in real time.

🔁 End-to-End Traceability

Compliance, traceability, and transparency are no longer optional. RoboCommodity’s ERP tracks commodities from farm to final delivery—perfect for meeting ESG standards and client audits. This level of detail isn’t just for compliance—it builds trust with buyers and opens up premium markets.

📉 Dynamic Risk Management

Every contract, hedge, and movement affects your exposure. RoboCommodity’s risk engine gives a live snapshot of portfolio risk, factoring in FX volatility, market movements, and logistics delays. Scenario modeling tools let you stress-test positions under various conditions—critical in today’s climate-sensitive markets.

💡 The New Competitive Edge

What used to take hours now takes minutes. What used to require multiple systems now is streamlined. Traders using ERP report faster execution, better insights, and reduced operational risk. In short, technology becomes their edge—not a bottleneck.

For organizational leaders, the message couldn’t be clearer: digital transformation isn’t merely a competitive advantage—it’s becoming an existential necessity. The question is no longer whether to transform, but how quickly comprehensive digital capabilities can be developed.

At Commodity Roundtable, we’re committed to facilitating this transformation journey through knowledge sharing, best practice development, and collaborative problem-solving. Our community of elite trading organizations represents the era of this new digital trading.

It seems like market volatility is staying longer with us than expected, the correlation between digital capability and trading performance will only strengthen. The organizations that thrive won’t necessarily be the largest or longest established, but rather those most adaptable to technological evolution.

The future belongs to the digitally resilient. The only question is whether your organization will be among them.

Adyasha Mallick is an AI Engineer and RoboCommodity consultant – Metal, focused on providing business digitization solutions to the Metal- global trading organizations. Connect with Commodity Roundtable to learn more about our executive forums and digital transformation resources.